Here few important Profit and Loss appropriation account related questions are given solved. These are the accountancy questions came in previous years of class 12 exams of West Bengal HS (WBCHSE). Go through the solved accountancy previous years papers to score better in HS exam!

Introduction to Profit and Loss Appropriation A/c

The Profit and Loss Appropriation account is the extended part of P/L account for a partnership firm or a joint stock company. Whenever there's more than one owner in a business, the profit or loss arising from the business needs to be distributed. The process of distribution or appropriation is done through this account.

This chapter carries 10 marks where 6 marks relate to MCQs and there is one 4-mark sum which you need to solved in the HS accountancy exam. Therefore, to help you to get an idea of the questions, we solved previous years' questions here. These questions are equally important for any other board exams also.

P/L appropriation account previoys years' solved questions

Question 1 (came in 2015's exam - adapted)

A, B and C are partners in a firm. Their capital balances as on 1.4.16 were ₹50,000, ₹60,000 and ₹70,000 respectively. Prepare Profit and Loss Appropriation Account for the year ended 31.3.17 after considering the following information:

(i) Interest on Capital @ 5% p.a.

(ii) C is entitled to get salary ₹1,500 p.m.

(iii) Net profit before charging above ₹51,000

(iv) Partners will share profit or loss equally.

|

| Credit: Basu and Basu |

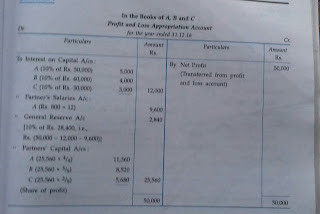

Question 2 (came in 2016's exam - adapted)

A, B and C are partners in a firm. Their capital balances as on 1.1.16 were ₹50,000, ₹40,000 and ₹30,000 respectively. Prepare Profit and Loss Appropriation Account for the year ended 31.12.16 after considering the following information:

(i) Interest on Capital @ 10% p.a.

(ii) A will get a monthly salary of ₹800

(iii) Net profit before considering the above is ₹50,000

(iv) 10% of profit should be transferred to general reserve

(v) The ratio of sharing profit and loss by A, B and C is 4:3:2.

|

| Credit: Basu and Basu |

Question 3 (came in 2017's exam)

Rabi and Shashi are partners in a firm sharing profits and losses in the ratio of 3:1. Net profit of the firm during the year ended 31st December, 2016 amounts to ₹3,00,000.

From the following information, prepare Profit & Loss Appropration Account of the firm for the year ended on 31st December, 2016:

(i) On 01.01.2016, the balances in the Capital and Current Accounts of the partners were:

Rabi: ₹1,60,000 (capital a/c); ₹20,000 (current a/c)

Shashi: ₹1,20,000 (capital a/c); ₹12,000 (current a/c)

(ii) Interest on Capital @ 5% p.a.

(iii) Interest on partners' drawing @ 10% p.a.

Drawing during the year were: Rabi = ₹40,000; Shashi = ₹30,000

(iv) Rabi is entitled to a comission of 5% of net profit before considering the above items.

Question 4 (came in 2018's exam)

A, B and C are partners in a firm with capitals ₹4,00,000, ₹3,00,000 and ₹3,00,000 respectively on 1st January, 2017. The partnership deed contains the following clauses:

(i) Interest on Capital @ 5% p.a.

(ii) Interest on drawing @ 6% p.a.

(iii) A gets salary ₹4,000 p.m.

(iv) B gets commission @ 10% on the Net Profit

(v) Profits and losses to be shared: A:B:C = 4:3:3

The net profit of the firm for the year ended 31st December, 2017 amounted to ₹4,80,000 and the drawings of the partners are: A = ₹ 30,000, B =₹20,000 and C = ₹10,000.

Prepare Profit and Loss Appropriation Account for the year ended on 31.12.2017.

Download the photos for the best view!

1 Comments

That's for the information

ReplyDeleteExpress your thoughts...